This 2026 income report examines how dental hygienists are paid across the US, comparing hourly wages and salaried roles. We analyze geographic and setting-based differences, total compensation and benefits, and evidence-based strategies to increase pay. The article guides hygienists and hiring managers through trends, negotiation tactics, and practical steps to maximize income and career value.

National pay landscape and hourly versus salary dynamics

The national pay landscape for dental hygienists has undergone a massive transformation between 2024 and 2026. Data from the Bureau of Labor Statistics (BLS) published in May 2024 established a median annual wage of $94,260 with a median hourly rate of $45.32. However, market conditions shifted rapidly. By late 2025, the Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles indicated that the national average had climbed toward $118,000. Most professionals now find themselves in a benchmark range between $79,000 and $156,000 annually. Wage aggregators like Payscale, Indeed, and Glassdoor reflect this upward trend, showing that hourly rates in high-demand regions frequently sit between $55 and $60.

Understanding Hourly versus Salary Structures

Most dental hygienists continue to work under an hourly pay model. This structure offers a base rate for every hour worked and provides clear protection under the Fair Labor Standards Act (FLSA). For nonexempt hourly workers, any time worked over 40 hours in a single week must be paid at a rate of 1.5 times the base pay. This is a significant advantage in busy practices where patient schedules often run late. Typical expectations involve 32 to 36 hours of clinical time per week, as many offices operate on a four-day schedule. On-call requirements remain rare in this field, though they do appear in specific hospital settings.

Salaried arrangements are less common but growing within corporate dental groups. These roles can be classified as exempt or nonexempt. To be considered exempt from overtime pay, an employee must meet specific duties tests and earn above the Department of Labor thresholds established in 2024 (starting at $844 per week and increasing in subsequent adjustments). Salaried hygienists often enjoy more predictable monthly income, yet they might miss out on the extra pay that comes with a packed clinical day that stretches past closing time. Some employers use a blended model where a base salary is guaranteed, but bonuses are added based on daily production or patient retention metrics.

Pay Dynamics by Employer Type

Private Dental Practices

The vast majority of private offices stick to hourly pay. This allows the owner to scale labor costs directly with the patient schedule. Benefits in these settings vary widely, often focusing on a high hourly rate rather than a robust insurance package. Per diem and contract work are also staples here, with temporary hygienists often commanding a premium rate of $70 or more per hour because they do not receive benefits.

Corporate Dental Groups

Large dental service organizations (DSOs) frequently offer more structured compensation. You might see a mix of hourly wages with comprehensive benefits including 401k matching and health insurance. Some DSOs are moving toward salaried roles for lead hygienists who take on administrative or training duties. These roles often include performance bonuses tied to the hygiene department’s total production. While corporate groups may offer lower base hourly rates, they provide structured paths for raises that private practices often lack.

Community Clinics and Public Health

Settings like federally qualified health centers usually offer hourly pay that might be slightly lower than private practice. However, they compensate with excellent public benefits and eligibility for the Public Service Loan Forgiveness (PSLF) program. The stability of these roles is a major draw for those prioritizing long-term financial security over immediate high hourly cash flow. Additionally, some public health and hospital-based roles may be part of larger healthcare unions, though collective bargaining remains rare in the wider dental hygiene field.

Hospitals and Specialty Practices

Hospitals are the most likely setting to offer traditional salaried positions with shift differentials for evening or weekend work. Specialty practices, such as periodontics, often pay a premium hourly rate because the work requires advanced clinical skills and longer appointment times.

Conversion Calculations and Benefits Valuation

Comparing an hourly offer to a salaried one requires a bit of math to see the true value. When calculating annual income from an hourly rate, it is important to account for unpaid holidays or office closures. Conversely, when looking at a salary, you should determine the effective hourly rate based on a standard work year of 2,080 hours for full-time roles.

Hourly to Annual Example Hourly Rate $58.00 Hours per Week 34 Weeks per Year 50 (accounting for 2 weeks unpaid) Annual Base $98,600 Value of Health Benefits $12,000 Total Compensation $110,600

Annual Salary to Hourly Example Annual Salary $110,000 Total Annual Hours 2,080 (40 hours x 52 weeks) Effective Hourly Rate $52.88

A high hourly rate without benefits might look better on a paycheck, but a lower salary with a 6% 401k match, paid time off, and fully covered health insurance often results in a higher net worth over time. Always factor in the employer’s contribution to FICA taxes for W-2 employees, which is 7.65%, compared to 1099 contractors who must pay the full 15.3% self-employment tax.

Primary SEO Keywords

dental hygienist salary 2026 hourly vs salary, dental hygienist pay by state, allied health salaries, dental hygienist income report 2026, RDH compensation trends.

Meta Description

Explore the 2026 dental hygienist income landscape. Compare hourly versus salary models, national wage data, and employer pay structures for dental professionals.

Regional state and setting variations that shape earnings

Geography remains the most powerful driver of your earning potential. While national averages provide a baseline, the actual paycheck you see depends heavily on your zip code. Recent data from the Bureau of Labor Statistics and various wage aggregators show a stark divide between coastal hubs and the inland South.

High and Low Earning States

The top five highest paying states for dental hygienists in 2025 include California, Alaska, Washington, Oregon, and Nevada. California leads the nation, driven by massive metro areas like San Jose where the median hits $135,010. The high pay here compensates for some of the most expensive housing markets in the country. Alaska follows closely; the pay there is a direct result of provider shortages, forcing practices to offer significant premiums to attract staff to remote locations. Washington and Oregon both hover in the top tier due to progressive scope of practice laws that allow hygienists to perform more autonomous work.

On the other end of the spectrum, the five lowest paying states include Mississippi, Kentucky, Florida, Arkansas, and Maine. Mississippi sits at the bottom with a median near $57,670. Low cost of living and limited Medicaid reimbursement rates keep wages suppressed in this region. Florida presents a unique case: despite high demand for dental services, the median wage is only $73,180. This is often attributed to a high density of providers and a large retiree population that relies on fixed incomes.

State Wage Comparison Table

| State Name | Median Annual Wage | Market Context |

|---|---|---|

| California | $127,090 | High cost of living and broad scope of practice |

| Alaska | $118,010 | Severe provider shortages and remote premiums |

| Washington | $125,370 | Strong demand in urban tech hubs |

| Mississippi | $57,670 | Low cost of living and limited funding |

| Florida | $73,180 | High provider density and competitive market |

Impact of Practice Settings

The type of facility where you work influences your pay structure and your career path. Most hygienists find employment in private general practices. These settings almost exclusively use hourly pay models. You can expect rates between $55 and $60 per hour in many regions. Benefits in small private offices are often limited to basic health insurance or dental perks. Career progression in these offices is often horizontal. You might gain more autonomy or take on office management tasks. Overtime is rare because these offices stick to strict business hours.

Specialty practices like periodontics or orthodontics often pay more. These roles require advanced clinical skills. You might see an extra $5 to $10 per hour compared to general practice. Corporate dental chains or Dental Service Organizations (DSOs) offer a different experience. They frequently use blended models. This might include a base hourly rate plus a percentage of production. DSOs usually provide more robust benefit packages including 401k matching and paid time off. Progression here is more vertical. You could move into a lead hygienist role or a regional trainer position.

Community health centers and school programs focus on public health. The hourly pay might be lower than private practice. However, these roles often qualify for the Public Service Loan Forgiveness program. This can be worth tens of thousands of dollars over several years. Hospital dental clinics usually offer salaried positions. These roles come with the stability of a large institution and opportunities for overtime during emergency shifts.

Urban Versus Rural Dynamics

Urban areas generally offer higher hourly rates. Metros like San Jose or Seattle pay 20 to 30 percent more than the state average. The competition for talent in these cities is fierce. However, rural areas are becoming increasingly competitive. Many rural clinics in states like Oregon or Alaska offer sign-on bonuses of $10,000 or more. Some even provide housing stipends.

Rural pay can sometimes result in higher discretionary income. While the raw salary might be lower than in a city, the cost of housing is significantly less. Many hygienists are moving to these areas to take advantage of loan repayment incentives. Programs in underserved areas can pay off up to $50,000 of student debt over two years. You can find more details on these trends in the Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles.

When considering a move to a high-paying state like Alaska or Washington, remember that the cost of living might erase gross income gains. A standard practice in high-demand areas is to request a relocation stipend of $5,000 to $10,000. This covers immediate moving costs without the long-term risk associated with a high-cost area.

Recommended Visualizations

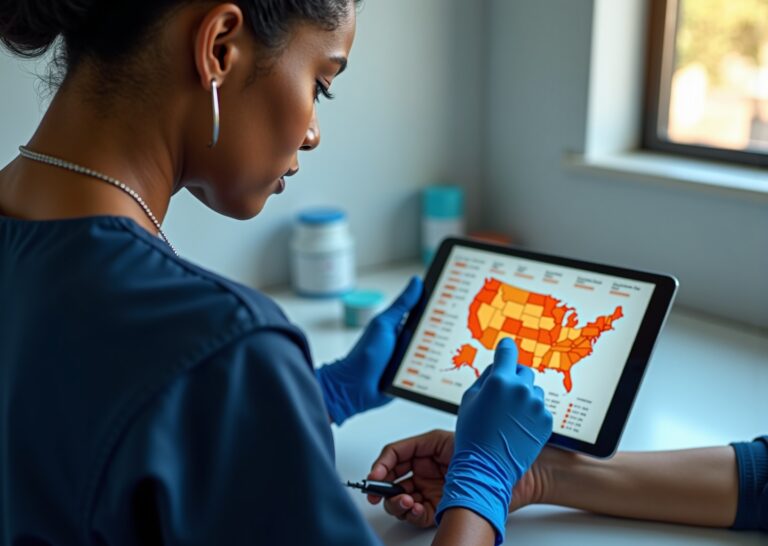

National Pay Heat Map

A color coded map of the United States showing median wages by state. This helps readers quickly identify high growth regions and geographic pay clusters.

Practice Setting Bar Chart

A chart comparing average annual earnings across private practice, corporate groups, and public health settings. This visualizes the trade off between base pay and total benefits.

Urban vs Rural Table

A table showing the pay gap in major states like California or Texas. It highlights the percentage premium paid in metro areas versus the incentives offered in rural counties.

Total compensation and benefits beyond base pay

Focusing only on the hourly rate is a common mistake when you evaluate a job offer. The base pay is the foundation, but the total compensation package determines your actual standard of living. In 2026, the competition for skilled hygienists has forced many offices to expand their offerings. You might see a high hourly rate at one office and a lower salary at another. The lower salary often comes with benefits that make it more valuable in the long run.

The components of a full package

Health and wellness benefits

Medical insurance is the most expensive benefit for employers to provide. A good plan covers a large portion of your premiums. Many offices now include dental and vision coverage. Some even offer life insurance or short term disability. These benefits protect your income if you cannot work due to illness or injury.

Retirement and savings

A 401k or a SIMPLE IRA is a standard expectation for full time roles. Many employers offer a match. This is usually between 3 percent and 6 percent of your pay. This match is essentially free money for your future. You should always contribute enough to get the full match.

Paid time off and professional costs

Paid time off includes vacation days, sick leave, and holidays. You should also look for continuing education allowances. Many offices provide $500 to $2,000 per year for classes. They might also reimburse you for your state license fees or professional liability insurance. These small costs add up to thousands of dollars over a year.

Bonuses and incentives

Sign on bonuses are common in high demand areas. You might see offers ranging from $5,000 to $15,000. Retention bonuses are paid after you stay for a year or two. Some offices use profit sharing or production based bonuses. These rewards link your pay to the success of the practice.

Calculating your total compensation

To compare two offers, you must turn every benefit into a dollar amount. Add your annual base pay to the estimated value of your benefits. Include any predictable bonuses. This gives you a clear picture of what you are actually earning. According to the Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles, the national average annual salary is approximately $118,000 when you consider these factors.

One sustainable way to increase take-home pay is to negotiate for non-taxable benefits. Ask your employer to pay your health insurance premiums or professional dues directly (“gross-up”). This reduces your taxable income while keeping the same level of support.

| Compensation Component | Example 1. Hourly Private Practice | Example 2. Salaried Corporate Group |

|---|---|---|

| Base Pay | $92,800 ($58/hr at 32 hrs/wk) | $95,000 (Annual Salary) |

| Health Insurance Value | $0 (Not provided) | $12,000 (Employer portion) |

| Retirement Match | $0 (Not provided) | $3,800 (4% match) |

| PTO Value | $0 (Unpaid) | $5,480 (3 weeks paid) |

| CE and License Fees | $500 (Partial) | $2,500 (Full coverage) |

| Annual Bonus | $1,000 (Holiday gift) | $5,000 (Production bonus) |

| Total Compensation | $94,300 | $123,780 |

Tax and payroll considerations

Your tax status changes how much money actually hits your bank account. Most hygienists are W-2 employees. This means the employer pays half of your FICA taxes. These taxes cover Social Security and Medicare. If you work as a 1099 contractor, you are responsible for the full 15.3 percent self employment tax. You must set aside money every month to pay the IRS. Per diem workers often get a higher hourly rate to make up for the lack of benefits. You should calculate if that higher rate covers the cost of buying your own health insurance and paying the extra taxes. The Dental Hygienists Occupational Outlook Handbook notes that the median wage was $94,260 in 2024, but your take home pay depends heavily on your tax classification.

Non monetary factors and quality of life

Money is not the only thing that matters. You must weigh the physical and mental toll of the job. A high paying office might have a heavy workload that leads to burnout. Consider the ergonomics of the operatory. Modern equipment can prevent career ending injuries. Schedule predictability is another major factor. Some offices offer flexible hours or four day work weeks. A short commute saves you time and reduces stress. You should think about the exposure risk and the safety protocols in the office. These factors do not show up on a paycheck, but they affect your long term happiness and health. When you negotiate, do not be afraid to ask for a better schedule or newer equipment if the base pay is already at the market rate. These adjustments can be more valuable than a small raise.

Career pathways and strategies to increase income

Increasing your earnings as a dental hygienist requires a move from passive clinical work to active value management. Most professionals in this field rely on annual cost of living adjustments. You can outpace these standard raises by focusing on specific metrics and clinical expansions. The current market shows a national average annual salary of approximately $118,000 according to the Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles. Reaching the higher end of this bracket involves a mix of immediate negotiation and long term skill acquisition.

Short Term Tactics for Immediate Pay Bumps

Hourly Rate Negotiation

Negotiation is most effective when backed by data. Avoid asking for more money based on personal needs. Use a script that highlights your contribution to the practice revenue.

I have reviewed my production numbers for the last two quarters. My average daily production is $1,400 and my patient retention rate is 92%. Current market data for our region shows a top tier rate of $65 per hour. I would like to adjust my compensation to this level to reflect the consistent value and patient loyalty I bring to the clinic.

Adding Responsibilities

If a straight raise is not possible, request a reclassification to a salaried exempt role that includes administrative or leadership duties. This might include managing infection control compliance or overseeing the hygiene department schedule. You can also negotiate shift differentials. Many offices struggle to fill evening or Saturday slots. Requesting an extra $5 to $10 per hour for these “hard to fill” shifts can significantly boost your weekly take home pay without increasing your total hours.

Per Diem and Overtime

The demand for hygienists remains high with 15,300 openings projected annually. You can leverage this by picking up per diem shifts through staffing apps or local networks. Per diem rates often sit between $70 and $80 per hour because the office does not pay for your benefits. If you are in a full time role, ensure you understand the overtime rules. Non exempt hourly workers must receive 1.5 times their base rate for any time over 40 hours in a week. If your office is short staffed, volunteering for these hours is the fastest way to see a larger paycheck.

Mid and Long Term Income Strategies

Clinical Specialization

Obtaining certifications in local anesthesia or laser periodontal therapy provides a direct return on investment. In many states, these skills allow you to perform more complex procedures that bill at higher rates. This increases your production value. Hygienists with advanced periodontal skills often earn $10,000 to $14,000 more per year than general practitioners. You should also look into expanded scope of practice credentials in states like Oregon or Washington where hygienists have more clinical autonomy.

Career Pivots

Moving beyond the chair can lead to higher salary ceilings. Clinical instructor positions at dental hygiene programs offer stability and professional prestige. If you have strong communication skills, consider sales or marketing roles for corporate dental programs or dental equipment manufacturers. These roles often include commission structures that clinical roles lack. Public health leadership positions are another path. While the base pay might be lower than private practice, the benefits packages and student loan repayment eligibility through programs like PSLF can result in a higher net worth over time.

Documenting Your Value

To win a negotiation, you must prove you are an asset. Keep a personal log of the following metrics.

- Daily production totals compared to the office average

- Patient retention and re-care percentages

- Number of successful treatment plan acceptances you initiated

- Completion of continuing education credits that added new services to the office

- Patient satisfaction scores or positive mentions in online reviews

- Infection control audits and compliance leadership

12 Month Income Growth Plan

| Timeline | Action Step | Expected Outcome |

|---|---|---|

| Months 1 to 3 | Track production and retention data daily. Research local market rates. | Establish a baseline for negotiation. |

| Months 4 to 6 | Complete a new certification like local anesthesia or CPR instructor training. | Increase clinical utility and justify a pay bump. |

| Months 7 to 9 | Negotiate a raise or pick up one per diem shift per month. | Immediate increase in monthly cash flow. |

| Months 10 to 12 | Apply for a lead hygienist role or transition to a higher paying setting. | Long term salary growth and leadership experience. |

Choosing Between Hourly and Salary

When to Stay Hourly

Hourly pay is usually better if you value flexibility or if the office frequently has schedule gaps. You get paid for every minute you are in the building. If the office has a high cancellation rate, ensure you have a “guaranteed hours” clause so you don’t lose money when a patient fails to show up.

When to Accept Salary

A salaried offer is attractive if it includes a full benefits package and a predictable schedule. However, you must negotiate a “hours cap” in the contract. Without a cap, you might find yourself working 45 hours for a 36 hour salary, which effectively lowers your hourly rate. Ensure the contract includes clear bonus triggers based on production and scheduled annual evaluation reviews. If the role is salaried exempt, you will not receive overtime pay, so the base salary must be high enough to cover any extra time spent on administrative tasks or late patients.

Contract Considerations

When reviewing employment contracts for either model, watch for restrictive clauses. Non-compete clauses can prevent you from working within a certain radius of the office for a year or more, while non-solicitation clauses prevent you from taking patients or staff with you if you leave. Always ask to remove or limit the geographic radius of any non-compete clause before signing. Additionally, watch for probationary pay periods where you earn less for the first 90 days.

Conclusions and next steps for readers

The data from the past two years confirms that the dental hygiene profession is in a period of significant transition. We have seen the national median annual wage reach $94,260 according to the latest Bureau of Labor Statistics updates. Some regions like Florida and California show even higher averages with hourly rates reaching $60 or more. This report shows that earning potential is no longer just about showing up for your shift. It is about understanding the mechanics of your pay structure and the specific demands of your local market.

Summary of Core Findings

The most successful hygienists in 2026 are those who treat their compensation as a total package rather than just a number on a paycheck. Hourly pay remains the dominant model for about 75 percent of the workforce. This model offers the most protection for those working in busy private practices where late patients or long procedures can lead to overtime. On the other hand, salaried roles are becoming more common in large dental service organizations. These roles often provide better health insurance and retirement matching but they require a careful look at exempt status to ensure you are not working extra hours for free.

Geography continues to be the biggest factor in pay variance. States like Alaska and Washington offer some of the highest wages in the country to combat staffing shortages. In contrast, states like Mississippi and Kentucky still lag behind the national average. If you are working in a high-cost area, your base pay should reflect the local cost of living plus a premium for your specialized skills. You can find more details on these regional differences in the Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles.

Strategies for Income Growth

Increasing your income in 2026 requires a focus on production and expanded functions. Offices are looking for hygienists who can do more than just basic cleanings. Obtaining certifications in local anesthesia or laser therapy can lead to an immediate pay bump of 10 to 15 percent. Tracking your daily production is another vital strategy. If you can show an employer that you generate three to four times your daily wage in revenue, you have a powerful tool for negotiation. Many offices are now open to profit-sharing or bonus structures based on patient retention and periodontal treatment acceptance.

Prioritized Action Plan

Collect Local Comparisons

Research at least three job postings in your immediate area to see current starting rates. Use resources like the Dental Hygienists : Occupational Outlook Handbook to verify median wages for your state.

Update Your Professional Resume

Highlight your specific production numbers and any advanced certifications. Mention your experience with specific dental software or digital scanning technology.

Track Your Production Metrics

Keep a log of your daily billable services for at least one month. Note your patient retention rate and the number of successful periodontal referrals you make.

Request a Formal Meeting

Schedule a time with your office manager or lead dentist specifically to discuss compensation. Avoid bringing this up during a busy clinical day.

Prepare Your Negotiation Script

Focus on the value you bring to the practice. Use phrases like “Based on my current production levels and the local market average of $60 per hour, I would like to discuss an adjustment to my rate.”

Explore Alternative Options

Look into locum tenens or per diem work if your current office cannot meet your salary requirements. Temporary roles often pay a premium of $10 to $20 more per hour than permanent positions.

Measurable Next Steps and Timelines

The First 30 Days

Complete your market research and update your resume. Start tracking your daily production numbers in a private spreadsheet. Identify one new certification you can earn this year.

The 90 Day Mark

Conduct your performance and pay review meeting with your employer. If a raise is not possible, negotiate for better benefits like more paid time off or a higher 401k match. Enroll in your chosen certification course.

The One Year Goal

Evaluate your total compensation against the 2027 market trends. If your income has not increased by at least 5 percent, consider moving to a new practice or a higher-paying setting like a specialty periodontal office.

Future Outlook to 2030

The demand for dental hygienists is projected to grow by 7 percent through 2034. This growth is driven by an aging population that requires more complex preventive care. Technological changes like artificial intelligence in diagnostic software will likely make hygienists more efficient. Regulatory changes in several states are also expanding the scope of practice for dental hygienists. These factors suggest that wages will continue to outpace inflation as the shortage of qualified clinicians persists through the end of the decade.

Tweet-length takeaway

Dental hygienist pay in 2026 is driven by production and location. Track your metrics and negotiate for total compensation to stay ahead of the 7% growth trend.

SEO H2 Suggestions

How to Negotiate Your Dental Hygienist Salary in 2026

Dental Hygienist Pay Trends and Future Job Outlook to 2030

Hourly vs Salary for Dental Hygienists: Which Model Pays More?

Sources

- Dental Hygienist Salary In US | Income Report 2026 – Hire Smiles — Most dental hygienists in the U.S. earn between $79,000 and $156,000 annually, with hourly rates typically ranging from $55 to $60 per hour depending on region …

- Dental Hygienist Salary: Your 2026 Guide – Coursera — A dental hygienist in the US makes, on average, $94,260 a year, according to the US Bureau of Labor Statistics (BLS) [1]. In a clinical …

- The 5 states where dental hygienist pay increased the most — Across the U.S., the average pay for dental hygienists increased $4,000 from 2023 to 2024, reaching $93,890. Here are the five states with the …

- Dental Hygienist Salaries Outpace Household Incomes in Several … — Dental hygienists are experiencing significant salary growth in 2025, with earnings surpassing average household incomes in multiple states.

- Dental Hygienists : Occupational Outlook Handbook — Pay. The median annual wage for dental hygienists was $94,260 in May 2024. Job Outlook. Employment of dental hygienists is projected to grow 7 percent from 2024 …

- How Much Does Hygienist Make? A Clear Look at Salaries in 2025 — The median dental hygienist salary in 2024 is $94,260 annually, while the average sits at about $78,343. · Where you work makes a huge difference …

- Which States Have the Highest RDH & Dental Assistant Wages … — Year-over-year, between Q3 of 2021 to Q3 of 2022, the national average income of RDHs increased by 4.5%, from $70,067 in 2021 to $73,745 in 2022 …

- Dental Hygienist Salary: What You Need to Know in 2026 — New graduates typically earn $55,000 to $65,000 annually, while experienced dental hygienists can earn $80,000 or more. This profession offers strong earning …

EMPTY